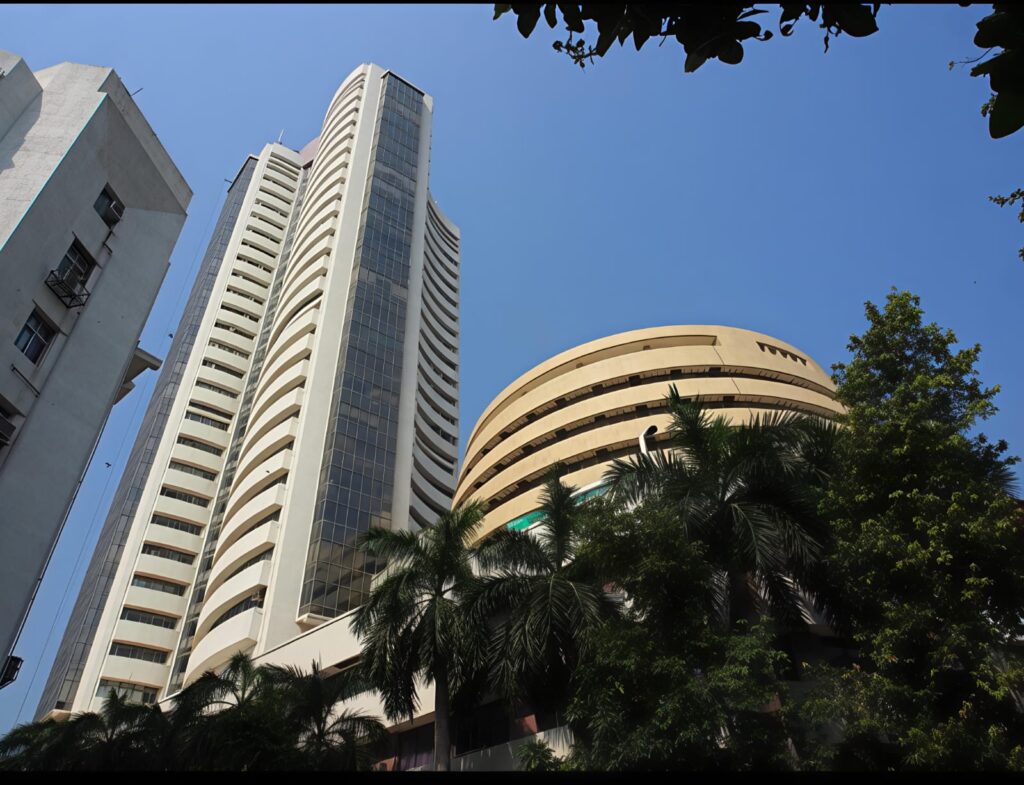

The vibrant floor of the BSE (formerly the Bombay Stock Exchange) once echoed with the frantic shouts of open-outcry traders. Today, those physical shouts have transformed into silent, lightning-fast digital signals. As the oldest stock exchange in Asia, the BSE stands as a monumental pillar of India’s economic story. Whether you are a seasoned investor or a curious beginner, understanding the BSE is your gateway to participating in one of the world’s fastest-growing economies.

What is the BSE and Why Does It Matter?

Established in 1875, the BSE has evolved from a small group of brokers under a banyan tree into a global financial titan. Consequently, it now ranks among the largest exchanges in the world by market capitalization. Investors look to the BSE because it provides a regulated, transparent marketplace for buying and selling shares, bonds, and derivatives.

Furthermore, the BSE acts as a barometer for the Indian economy. When the exchange performs well, it often signals high investor confidence and robust corporate health. Conversely, a dip in the BSE indices can reflect broader macroeconomic challenges. Therefore, keeping a close eye on this institution is essential for anyone serious about wealth creation.

The Iconic SENSEX: The Heartbeat of the Market

You cannot discuss the BSE without mentioning the SENSEX. This index tracks the performance of 30 well-established and financially sound companies listed on the exchange.

Market Representation: It represents the most influential sectors of the Indian economy.

Liquidity: The stocks within the SENSEX are highly liquid, meaning you can buy or sell them easily.

Historical Significance: Since its inception in 1986, it has become the standard benchmark for Indian equity markets.

The Historical Evolution of the BSE

Understanding where the BSE came from helps you appreciate its current stability. In the mid-19th century, four Gujarati and one Parsi stockbroker started meeting under banyan trees in front of the Town Hall of Bombay. As the group grew, the location shifted multiple times until they finally settled on Dalal Street in 1874. Consequently, the “Native Share and Stock Brokers’ Association” was officially born.

In contrast to modern high-frequency trading, those early days were slow and physical. However, the BSE quickly became the center of Indian capitalism. During the American Civil War, the resulting cotton boom saw a massive surge in trading activity on the BSE. This period proved that the exchange could handle global economic shifts.

By the late 20th century, the BSE realized that manual systems were becoming obsolete. Consequently, it transitioned to the BSE Online Trading (BOLT) system in 1995. This move was revolutionary. It allowed the BSE to increase its capacity from a few thousand trades a day to millions of transactions per second.

How the BSE Operates in the Modern Era

Transitioning from manual trading to a fully electronic system, the BSE now utilizes the BOLT system as its backbone. This technology ensures that orders are executed with incredible speed and accuracy. In contrast to the old days of paper certificates, modern investors hold their assets in “dematerialized” or Demat accounts.

The Role of SEBI

The Securities and Exchange Board of India (SEBI) acts as the watchful guardian of the BSE. Because SEBI enforces strict regulations, investors can trade with a sense of security. This regulatory oversight builds the Trustworthiness that is vital for any financial ecosystem. Specifically, SEBI ensures that the BSE maintains fair practices and protects small retail investors from market manipulation.

Step-by-Step: How to Start Investing on the BSE

If you feel ready to dive in, you must follow a specific path. Many beginners feel overwhelmed, but the process is actually quite straightforward when broken down.

Select a Depository Participant (DP): You need a broker who is a member of the BSE.

Open a Demat and Trading Account: These accounts allow you to store shares and execute trades.

Complete the KYC Process: Submit your PAN card, Aadhaar, and bank details to verify your identity.

Fund Your Account: Transfer capital from your bank account to your trading platform.

Analyze and Execute: Use the BSE website or your broker’s app to research companies before hitting the “buy” button.

Practical Tips for First-Time Traders

Start Small: Don’t dump your entire savings into the BSE on day one.

Diversify: Spread your investments across different sectors like IT, Banking, and Healthcare.

Think Long-Term: The BSE rewards patience. Avoid the trap of “panic selling” during temporary market fluctuations.

Decoding the Different Segments of the BSE

The BSE is not just about stocks. It offers a diverse menu of financial instruments designed to meet various risk appetites.

Equity Market

This is where most retail investors spend their time. By purchasing shares on the BSE, you essentially own a piece of a company. If the company grows, your share value increases. Moreover, many BSE-listed firms pay dividends, providing a steady stream of passive income.

Debt Market

For those who prefer lower risk, the BSE debt segment offers corporate and government bonds. In essence, you are lending money to an entity in exchange for fixed interest payments. Consequently, this is a popular choice for retirees or conservative savers.

Derivatives (Futures and Options)

Experienced traders often use the BSE derivatives segment to hedge their risks or speculate on price movements. However, these instruments are complex. Therefore, you should gain significant experience before venturing into this high-stakes arena.

The SME Platform

One of the most exciting developments at the BSE is the SME (Small and Medium Enterprises) platform. Because smaller companies often struggle to find capital, the BSE created a specific ecosystem for them. Investing here is riskier, but it offers the chance to find the “next big thing” before it hits the main board.

Why the BSE is Unique ?

From an expert standpoint, the BSE holds a level of Authoritativeness that few other institutions can match. Its long history provides a massive data set for analysts. Furthermore, the BSE SME platform has revolutionized how small businesses raise capital. This specialized segment allows smaller enterprises to list without the stringent requirements of the main board, fostering innovation across India.

Technological Leadership

Interestingly, the BSE is known for being one of the fastest stock exchanges in the world, with a median response speed of 6 microseconds. This technical Expertise ensures that institutional investors and high-frequency traders can operate efficiently. As a result, the BSE remains competitive on a global scale.

Understanding BSE Market Capitalization

Market capitalization is a key metric on the BSE. It is calculated by multiplying the total number of a company’s shares by the current share price. Consequently, companies on the BSE are categorized into three main buckets:

Large-Cap Companies

These are the giants of the BSE. They are usually the 100 largest companies by market cap. Because they are stable and well-established, they offer lower risk. However, their growth might be slower compared to smaller firms.

Mid-Cap Companies

In contrast, mid-cap companies on the BSE occupy the middle ground. They have the potential for high growth but come with moderate risk. Many investors find that these stocks offer the best balance for wealth creation.

Small-Cap Companies

These are the smaller players on the BSE. While they can offer explosive returns, they are also highly volatile. Therefore, you should only allocate a small portion of your portfolio to this segment.

Common Mistakes to Avoid on the BSE

Even with the best tools, many investors lose money because they ignore fundamental rules. To succeed on the BSE, you must master your emotions.

Chasing “Tips”: Never buy a stock just because a “guru” on social media recommended it. Always verify the data on the official BSE portal.

Ignoring Costs: Brokerage fees and STT (Securities Transaction Tax) can eat into your profits. Always calculate your break-even point.

Failing to Rebalance: Your portfolio on the BSE should be reviewed at least once a quarter. If one stock grows too large, it might be time to sell some and reinvest elsewhere.

Emotional Trading: Fear and greed are your worst enemies on the BSE. Consequently, you should always stick to a pre-defined trading plan.

The Future of the BSE: Sustainability and ESG

As we look toward the future, the BSE is pivoting toward sustainable investing. Environmental, Social, and Governance (ESG) factors are becoming critical for modern investors. Consequently, the BSE has launched indices that track companies with high ESG scores.

By prioritizing these metrics, the BSE attracts international capital from funds that only invest in ethical businesses. This shift not only helps the planet but also ensures the long-term Experience of the market is aligned with global standards.

Digital Expansion and Mobile Trading

The BSE continues to invest heavily in mobile-first technologies. Because most young Indians access the internet via smartphones, the BSE has made its data more accessible than ever. This democratization of data means that a farmer in rural India has the same access to BSE price alerts as a fund manager in Mumbai.

Building a Winning Strategy on the BSE

To win consistently, you need a system. Relying on luck is a recipe for disaster. Instead, consider these primary schools of thought:

Fundamental Analysis

This involves looking at a company’s financial statements, management quality, and industry position. When you buy a stock on the BSE based on fundamentals, you are betting on the company’s intrinsic value. You look for high Return on Equity (ROE) and low debt-to-equity ratios.

Technical Analysis

In contrast, technical analysts look at charts and patterns. They use BSE historical price data to predict future movements. While it requires more study, it can be a powerful tool for short-term trading. Moving averages, RSI (Relative Strength Index), and MACD are common tools used to analyze BSE stocks.

Pro Tip: The most successful investors on the BSE often combine both methods. They use fundamental analysis to pick “what” to buy and technical analysis to decide “when” to buy it.

The Role of Global Events on the BSE

While the BSE is an Indian exchange, it does not exist in a vacuum. Events in the United States, Europe, or China can significantly impact the BSE. For example, if the US Federal Reserve raises interest rates, foreign institutional investors (FIIs) might pull money out of the BSE.

Consequently, staying informed about global geopolitics is a requirement for serious BSE traders. Furthermore, oil prices are particularly important for India. Since India imports a lot of oil, high prices can hurt the profitability of BSE-listed companies in sectors like aviation and logistics.

Navigating the BSE Website for Research

The official BSE website is a goldmine of information. Many retail investors ignore it, which is a mistake.

Corporate Announcements

Every time a company listed on the BSE does something important, they must announce it. This includes earnings reports, mergers, or changes in leadership. By reading these directly from the BSE, you avoid the “filter” of news media.

Shareholding Patterns

Who owns the company? The BSE provides a breakdown of shareholding patterns. If you see that promoters (the owners) are buying more shares of their own company on the BSE, it is usually a very bullish sign.

Bulk and Block Deals

The BSE lists large trades made by big institutions. If a famous investor buys a massive stake in a small company on the BSE, the market often reacts positively. Monitoring these deals can give you a “heads up” on where the big money is moving.

Conclusion: Your Journey with the BSE Starts Today

In summary, the BSE is more than just a place to trade numbers; it is the engine of Indian prosperity. By understanding its history, mastering its tools, and following a disciplined strategy, you can build significant wealth over time. The BSE offers a level of transparency and opportunity that was once reserved for the elite. Now, that power is in your hands.

Furthermore, remember that every expert was once a beginner. The key is to keep learning, stay updated with BSE announcements, and remain patient. The markets may fluctuate, but the long-term trajectory of the BSE has historically been upward.

As India moves toward becoming a $5 trillion economy, the BSE will undoubtedly play a leading role. By starting your investment journey now, you position yourself to ride the wave of India’s growth.